Introduction to Linear Regression

Linear regression is one of the most fundamental and widely

used statistical techniques in data analysis and machine learning. At its core,

linear regression aims to model the relationship between a dependent variable

and one or more independent variables by fitting a linear equation to observed

data.

Mathematically, a simple linear regression model can be

represented as:

y = β0 + β1x + ε

Where:

· y is the dependent variable.

· x is the independent variable.

· β0 is the y-intercept.

· β1 is the slope of the line.

· ε is the error term.

In a multiple linear regression scenario, the equation

expands to:

y = β0 + β1x1 + β2x2 + .......... + βnxn + ε

Where x1, x2, ..., xn are

multiple independent variables.

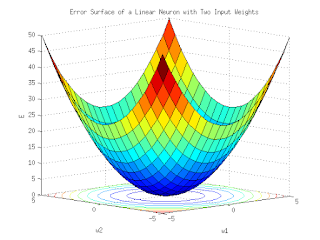

The goal of linear regression is to determine the values of β0

and β1 (or β1, β2, ..., βn in the

case of multiple regression) that minimize the sum of squared errors between

the predicted values and the actual values.

Applications

of Linear Regression

Linear regression is a versatile tool used in various fields

to predict outcomes and analyze trends. Some of the key areas where linear

regression is applied include:

1. Economics: Forecasting economic indicators such as

GDP, unemployment rates, and inflation.

2. Finance: Modeling relationships between financial

metrics, such as risk and return.

3. Healthcare: Predicting patient outcomes based on

medical histories and other factors.

4. Marketing: Estimating the impact of advertising

spend on sales.

5. Real Estate: Valuing properties based on features

like location, size, and age.

6. Environmental Science: Assessing the impact of

environmental variables on climate change.

Linear

Regression in Stock Market Analysis

In the realm of stock market analysis, linear regression is

a powerful tool for predicting stock prices and understanding market trends.

Analysts use historical price data and various financial indicators to build

regression models that can forecast future stock prices.

How

Linear Regression is Used in the Stock Market

1. Trend Analysis: By examining the relationship

between time and stock prices, analysts can identify long-term trends and

potential turning points.

2. Price Prediction: Using historical data, analysts

can predict future stock prices by modeling the relationship between a stock's

past performance and various market factors.

3. Risk Management: Linear regression helps in

assessing the volatility of stock returns, aiding in the development of risk

management strategies.

4. Portfolio Optimization: By analyzing the

relationships between different stocks, investors can optimize their portfolios

for better returns.

Example:

Using Python to Predict Stock Prices with Linear Regression

Let's dive into a practical example where we pull data from

the National Stock Exchange (NSE) of India and use linear regression to predict

stock prices.

Conclusion

Linear regression is an invaluable tool for predicting stock

prices and analyzing market trends. It provides a straightforward yet powerful

approach to understanding the relationships between various market factors and

stock performance. While time series analysis is a widely used method in

predicting stock prices, we cannot overlook the importance of other machine

learning models, which offer diverse perspectives and can enhance predictive

accuracy.

Moreover, linear regression can be applied to momentum

indicators such as moving averages and relative strength indices (RSI) to

forecast stock prices further. These indicators help identify the strength and

direction of market trends, providing additional insights into future price

movements.

In the ever-evolving landscape of stock market analysis,

machine learning has brought new momentum and perspective, enabling analysts to

make more informed decisions and optimize their investment strategies.

Thank you for taking the time to read this post. If you

enjoyed the content and found it useful, please share it with others and follow

my blog for more insightful articles on data analysis and machine learning.

Happy investing🤑💲🤑!

No comments:

Post a Comment